Why is the USD to INR Exchange Rate down today on 29th July 2022 (2nd half of July 2022)?

Despite the preventive measures taken by the Indian government and the Reserve Bank of India (RBI), the Indian economy and currency have been growing weaker to reach a nadir point of $1, equalling 80 rupees. This is a bad state for the country and its economy. However, foreign investors wanting to invest in India may see it as a positive sign, but that is specious. A country's currency is highly dependent on economic and political stability. The RBI, which protects macroeconomic stability, has come up with several monetary policies and contingency plans to help bolster the rupee.

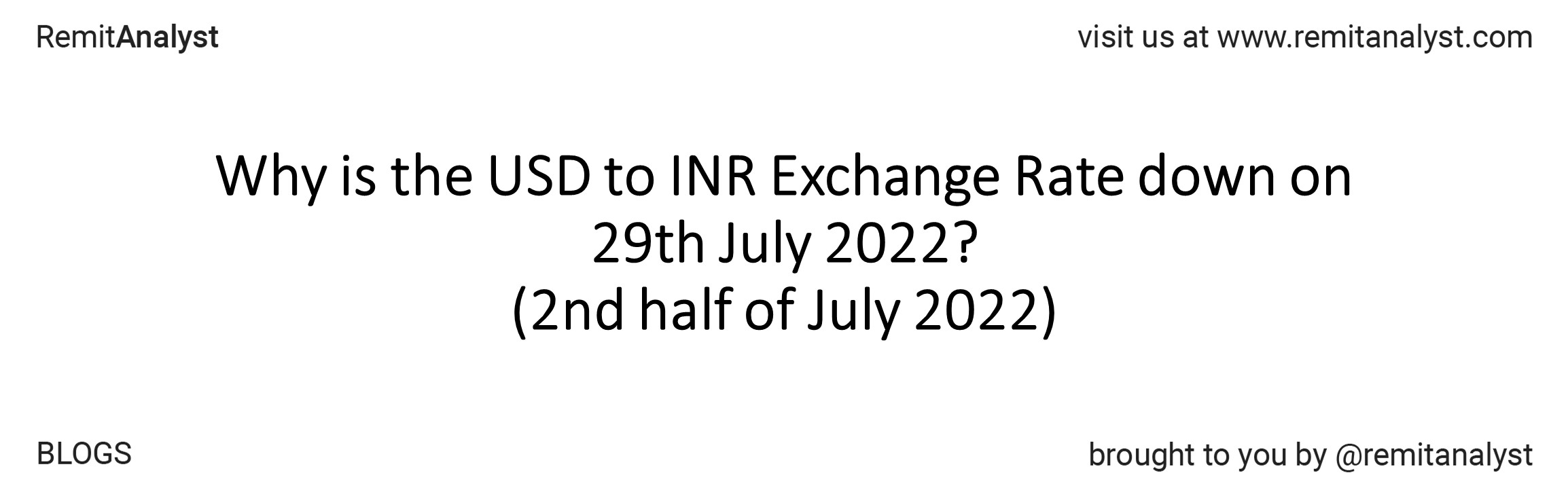

| USD to INR Exchange Rates | ||||

|---|---|---|---|---|

| Date | Open | High | Low | Close |

| Jul-19-2022 | 80.03 | 80.15 | 79.85 | 80.03 |

| Jul-20-2022 | 79.86 | 80.12 | 79.86 | 79.86 |

| Jul-21-2022 | 80.00 | 80.27 | 79.76 | 80.00 |

| Jul-22-2022 | 79.78 | 80.08 | 79.78 | 79.78 |

| Jul-25-2022 | 79.88 | 80.14 | 79.69 | 79.88 |

| Jul-26-2022 | 79.72 | 79.84 | 79.70 | 79.72 |

| Jul-27-2022 | 79.84 | 80.07 | 79.75 | 79.84 |

| Jul-28-2022 | 79.85 | 80.06 | 79.60 | 79.85 |

| Jul-29-2022 | 79.57 | 79.66 | 79.17 | 79.57 |

Looking closely at the rupee’s performance against the US dollar, we can infer that a dollar has equaled an average of 79.8 rupees. The rupee has hit an all-time low of 80. The rupee hit a bottom of 80.27 on Jul 21, 2022, and a peak of 79.1 on Jul 29, 2022. The graph suggests that the rupee performs better than it did two weeks ago. It may seem like a positive sign. However, the performance has been pretty volatile. The rupee's value has been increasing and decreasing sporadically. The currency's value differed positively or negatively by an average of 0.07 rupee every day in the past two weeks (Jul 19, 2022, to Jul 29, 2022). Such a low variance suggests that the rupee is finding some stability; however, it will take time. If the currency has to be solid and stable, there are so many factors that have to perform relatively well. They are:

1. Crude Oil

Today, every country is dependent on one another for goods and trade. Trade barriers get imposed when unprecedented situations like the coronavirus pandemic and the Ukraine- Russia conflict. Since a country's value depends on the trade balance, every country needs to maintain a positive delta to help boost their economies. However, trade barriers aren't helping. For Instance, Russia stopped exporting crude oil for a while, which increased the price of crude oil. In May 2022, the prices of oil touched an all-time high of $120 per barrel. India imports over 85% of crude oil from other countries. In the first quarter of the financial year 2022- 23, India imported 60.2 million tonnes of oil worth $47.5B. This was significantly higher by 89% than the amount spent in the previous quarter (fourth quarter of the financial year 2021-22).

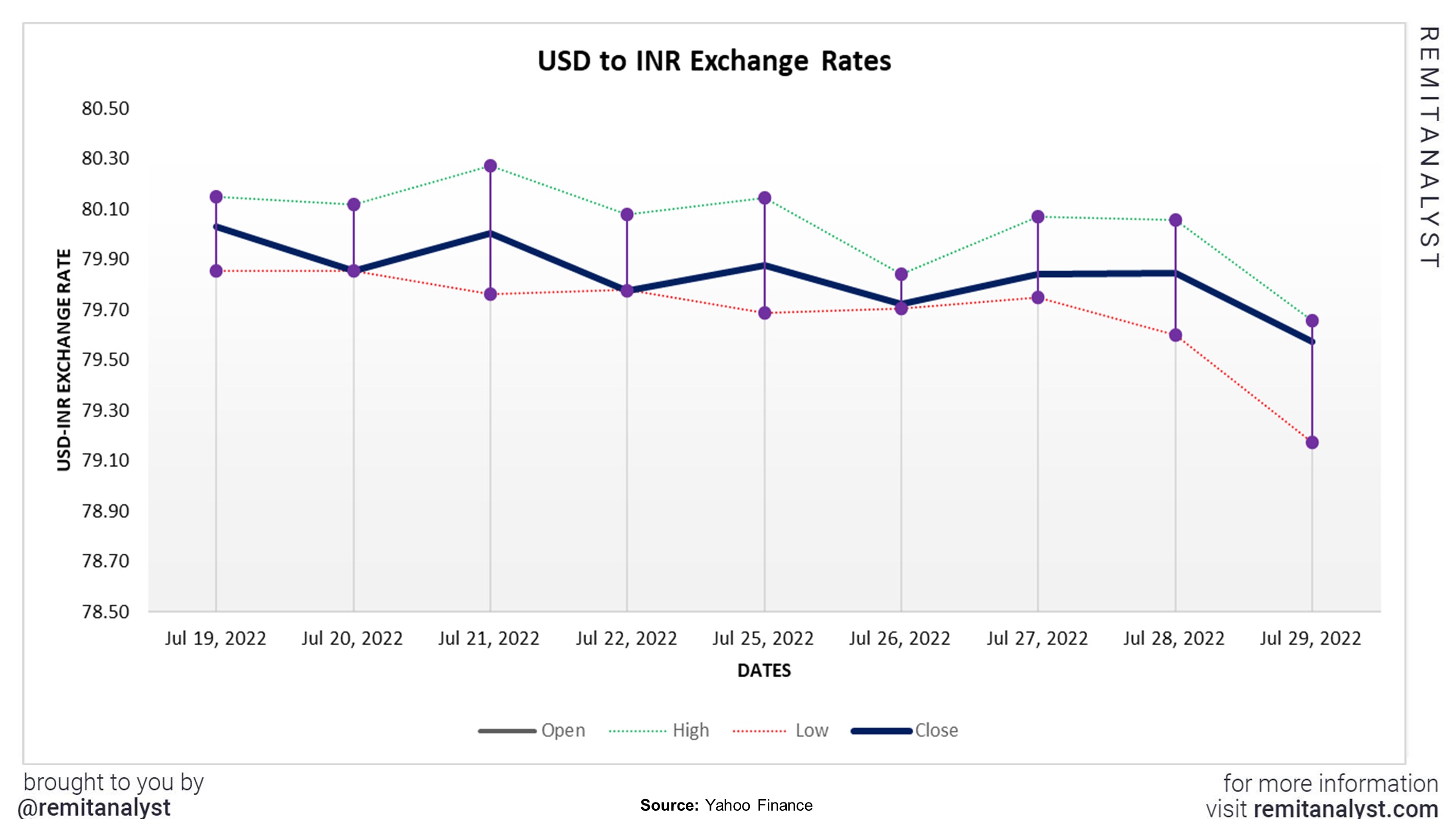

| Crude Oil (in USD) | ||||

|---|---|---|---|---|

| Date | Open | High | Low | Close |

| Jul-19-2022 | 102.00 | 104.46 | 99.85 | 104.22 |

| Jul-20-2022 | 103.60 | 104.39 | 101.51 | 102.26 |

| Jul-21-2022 | 99.91 | 99.99 | 94.59 | 96.35 |

| Jul-22-2022 | 96.51 | 97.95 | 94.23 | 94.70 |

| Jul-25-2022 | 95.10 | 96.94 | 93.01 | 96.70 |

| Jul-26-2022 | 96.33 | 99.00 | 94.76 | 94.98 |

| Jul-27-2022 | 95.60 | 98.59 | 94.30 | 97.26 |

| Jul-28-2022 | 98.17 | 99.84 | 96.04 | 96.42 |

| Jul-29-2022 | 97.30 | 101.88 | 96.41 | 98.62 |

The price decreased significantly from Jul 19, 2022, to Jul 22, 2022. However, the price has been unstable ever since. On Jul 19, 2022, the prices peaked at a value of $104.46 per barrel, whereas on Jul 25, 2022, prices reached a low of $93.01 per barrel. Every manufacturing, transportation, and many related industries are highly dependent on crude oil. Such expenditures can hinder the production process, raise the inflation level, and devalue the Indian currency.

2. Gold imports

India has officially entered the wedding season. The demand for gold has increased tremendously. The demand increased by 43% from last year's demand of 170.7 tonnes in the quarter through June. As of Jun 30, 2022, India imported about 306.2 tonnes of gold. It had severe repercussions in terms of inflation as it rose significantly over 7% in June 2022. A countermeasure of increasing the gold import tax from 10.75% to 15% was brought into effect in July 2022. This measure was authorized by the RBI and the government of India. On Jul 29, 2022, gold price reached a high of $1765.70.4 per ounce and a low of $1679.7 on Jul 21, 2022.

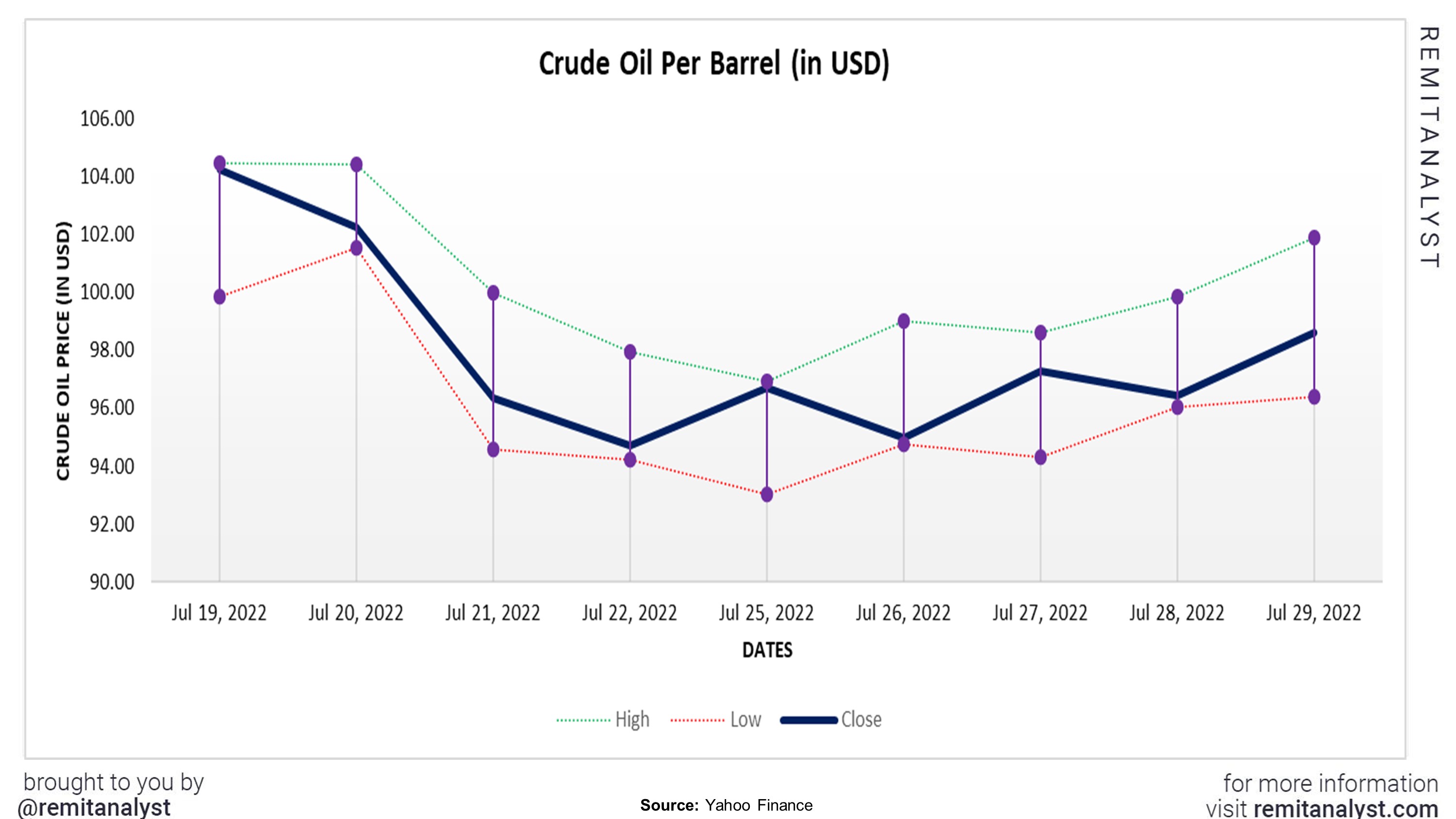

| Gold Rate (in USD) | ||||

|---|---|---|---|---|

| Date | Open | High | Low | Close |

| Jul-19-2022 | 1,712.30 | 1,714.40 | 1,706.10 | 1,710.00 |

| Jul-20-2022 | 1,707.10 | 1,708.50 | 1,699.50 | 1,699.50 |

| Jul-21-2022 | 1,687.00 | 1,715.50 | 1,679.80 | 1,712.70 |

| Jul-22-2022 | 1,713.30 | 1,735.00 | 1,713.00 | 1,727.10 |

| Jul-25-2022 | 1,727.00 | 1,732.00 | 1,719.00 | 1,719.00 |

| Jul-26-2022 | 1,718.00 | 1,718.00 | 1,717.70 | 1,717.70 |

| Jul-27-2022 | 1,719.10 | 1,719.10 | 1,719.10 | 1,719.10 |

| Jul-28-2022 | 1,732.30 | 1,755.00 | 1,732.00 | 1,750.30 |

| Jul-29-2022 | 1,754.00 | 1,765.70 | 1,750.00 | 1,762.90 |

The price has been decreasing gradually, which has also added fuel to the people's desire to buy gold. On average, gold costs around $ 1722.19 per ounce. The prices have decreased from the first two weeks of July and are expected to increase further. It poses a worrying sign for the country and its economy. The more the gold imports, the higher the inflation rates, and the lower the currency's value. It isn't helpful to the country when gold purchases increase.

3. GDP & Import/Export

The gross domestic product or GDP and the trade balance between the imports and exports of a country are all interrelated. When a government maintains a negative delta in the trade balance, it hurts the GDP. That is, the GDP decreases which in turn devalues the currency. The GDP is also dependent on consumer spending and consumption rates.

| India: Imports & Exports (in US$ Million) | ||||

|---|---|---|---|---|

| Date | Export (US$ Million) | Import (US$ Million) | ||

| Jun-21 | 20.30 | 10.84 | ||

| Jul-21 | 19.36 | 11.39 | ||

| Aug-21 | 20.46 | 11.87 | ||

| Sep-21 | 21.61 | 12.58 | ||

| Oct-21 | 19.85 | 11.61 | ||

| Nov-21 | 20.14 | 12.59 | ||

| Dec-21 | 25.31 | 14.89 | ||

| Jan-22 | 21.63 | 13.24 | ||

| Feb-22 | 21.30 | 12.97 | ||

| Mar-22 | 26.95 | 15.35 | ||

| Apr-22 | 22.59 | 14.05 | ||

| May-22 | 23.61 | 15.20 | ||

| Jun-22 | 25.29 | 15.77 | ||

The graph below shows that the trade deficit gap has been widening unpredictably. From April 2022 to June 2022, the imports and exports had a linear growth making an almost negligible difference in the trade deficit. India had a deficit of $8.411M in May 2022. It has increased to $9.525M in June 2022. This increase is worrying.

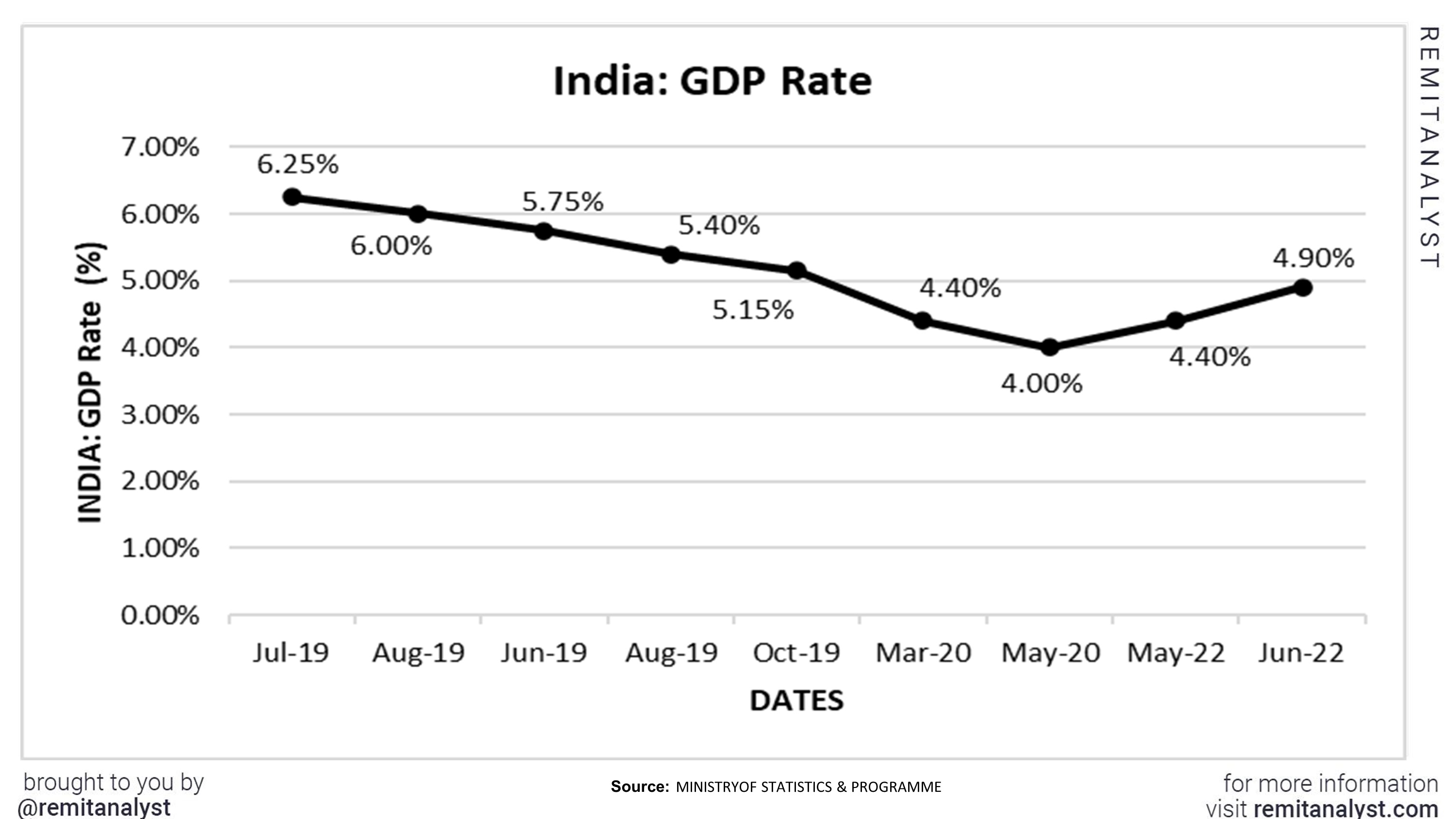

| GDP Rate in India | ||||

|---|---|---|---|---|

| Date | Rate (%) | |||

| Jul-19 | 6.25% | |||

| Aug-19 | 6.00% | |||

| Jun-19 | 5.75% | |||

| Aug-19 | 5.40% | |||

| Oct-19 | 5.15% | |||

| Mar-20 | 4.40% | |||

| May-20 | 4.00% | |||

| May-22 | 4.40% | |||

| Jun-22 | 4.90% | |||

Though the trade deficit has increased, the GDP has grown instead of declining. The GDP has risen from 4.4% in May 2022 to 4.9% in June 2022. However, this growth is slow. The Indian government and the RBI aim to recover and restore the GDP rates by 2023. It seems like a positive sign for the country's economy and currency.

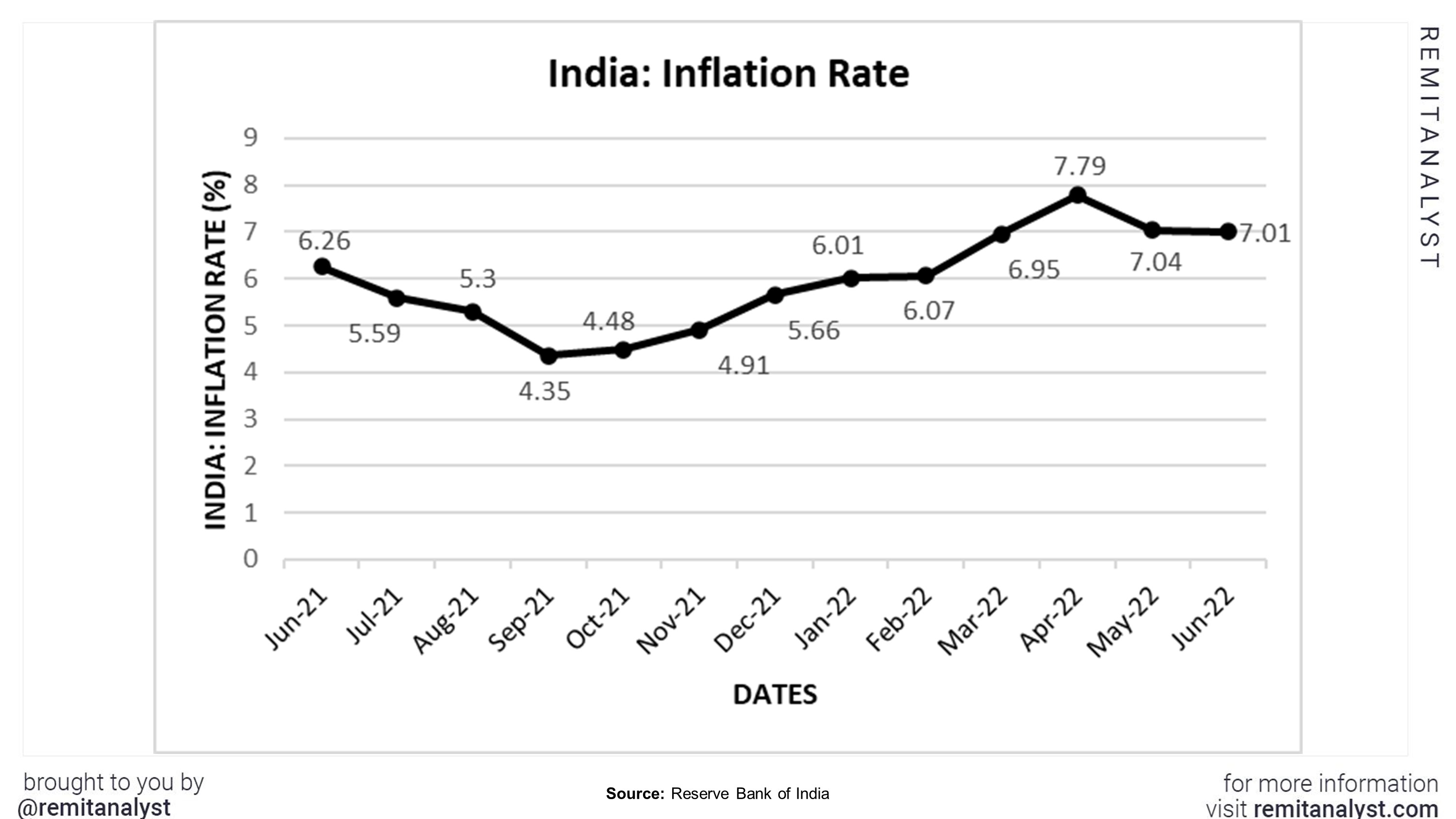

4. Inflation rates

Most of the import and export trades affect the inflation rates. A decrease in inflation suggests that the country's economy and currency are performing relatively well. At the same time, a rise in inflation rates is considered dangerous as it can devalue a currency by decreasing its buying power. The inflation rates of India have been rising since September 2021. The growth appeared to slow down in the first two months of 2022. However, that stability was specious. The rates increased significantly in March 2022 and have been growing ever since. From 7.79% in April 2022, the inflation rates have fallen to 7.01% in June 2022. This appears as a good sign; however, the currency's performance against the dollar does not reflect that despite the efforts of the government and the RBI.

| India's Inflation rates | ||||

|---|---|---|---|---|

| Date | Percentage | |||

| Jun-21 | 6.26 | |||

| Jul-21 | 5.59 | |||

| Aug-21 | 5.3 | |||

| Sep-21 | 4.35 | |||

| Oct-21 | 4.48 | |||

| Nov-21 | 4.91 | |||

| Dec-21 | 5.66 | |||

| Jan-22 | 6.01 | |||

| Feb-22 | 6.07 | |||

| Mar-22 | 6.95 | |||

| Apr-22 | 7.79 | |||

| May-22 | 7.04 | |||

| Jun-22 | 7.01 | |||

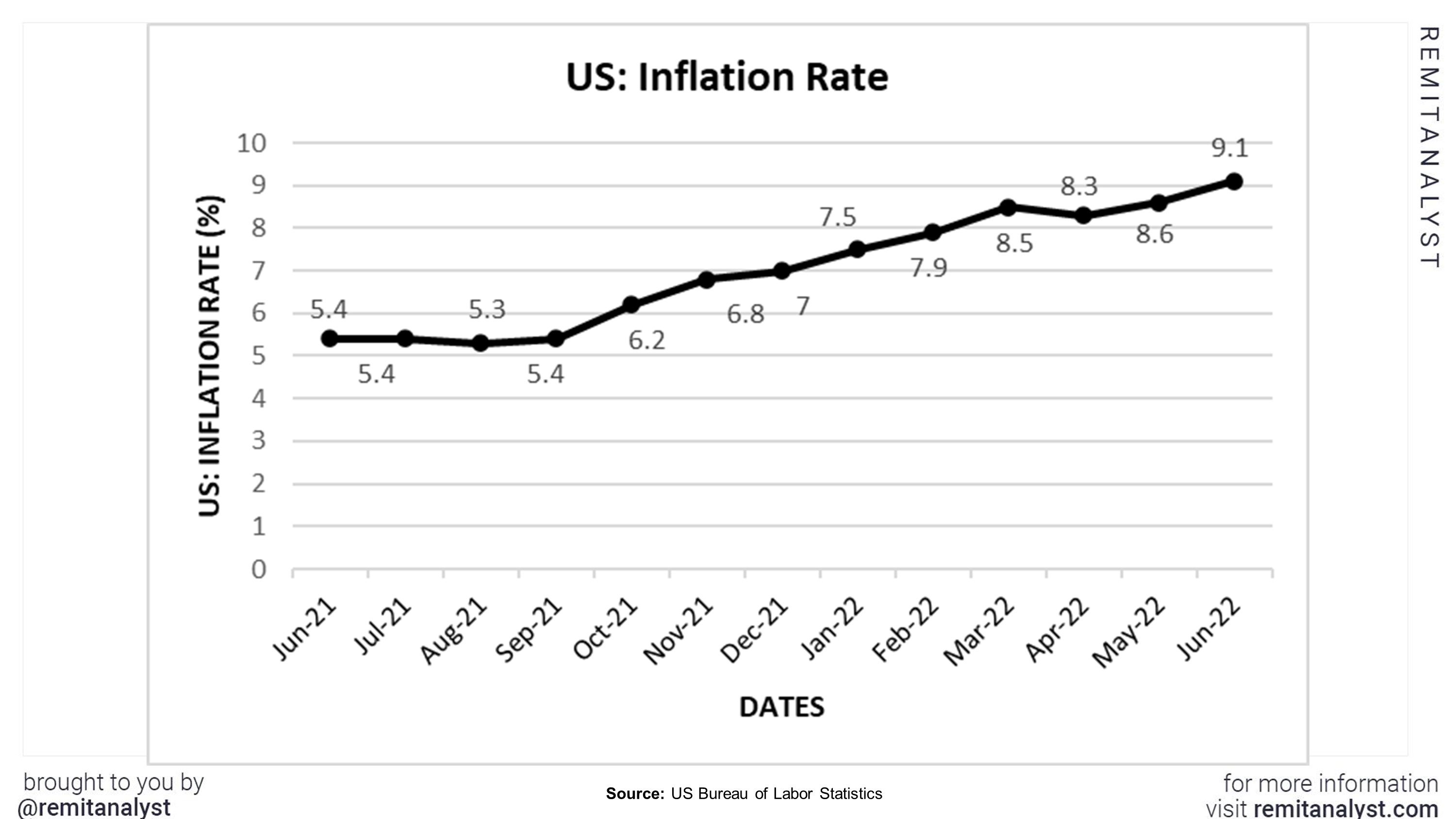

| US Inflation rates | ||||

|---|---|---|---|---|

| Date | Percentage | |||

| Jun-21 | 5.4 | |||

| Jul-21 | 5.4 | |||

| Aug-21 | 5.3 | |||

| Sep-21 | 5.4 | |||

| Oct-21 | 6.2 | |||

| Nov-21 | 6.8 | |||

| Dec-21 | 7 | |||

| Jan-22 | 7.5 | |||

| Feb-22 | 7.9 | |||

| Mar-22 | 8.5 | |||

| Apr-22 | 8.3 | |||

| May-22 | 8.6 | |||

| Jun-22 | 9.1 | |||

Just like India, every other country faces the perils of rising inflation rates. Even in the United States, inflation rates have been growing. The inflation rate decreased from 8.5% in March 2022 to 8.6% in May 2022. However, it has increased to 9.1% in June 2022. The US Federal Reserve has taken measures such as expanding the repo rates by 75 basis points to help curb the inflation rates. The rates are expected to increase until it stabilizes in late 2023 and early 2024.

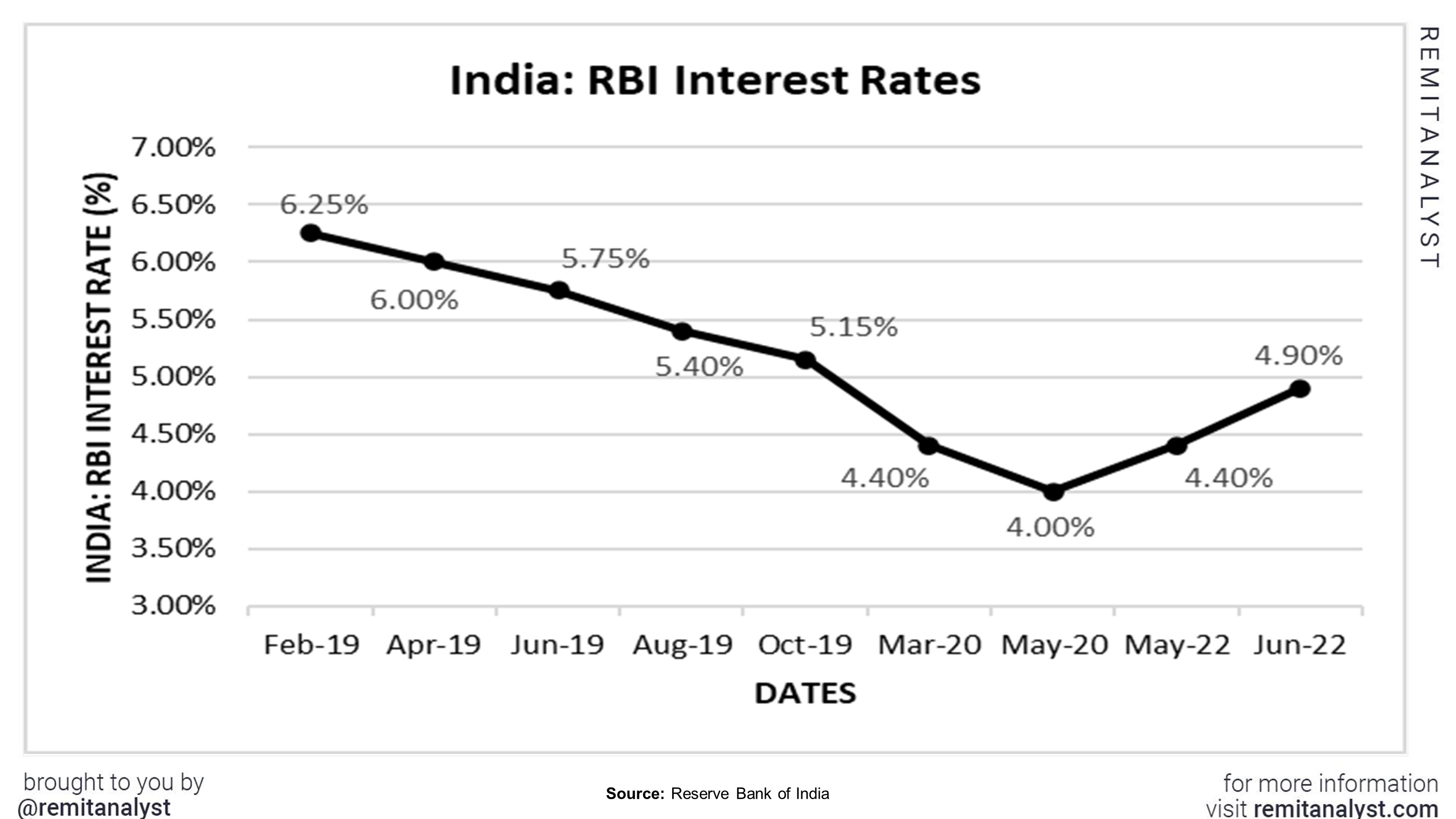

5. Interest rates

One of the many textbook methods the RBI or any central bank uses is playing with the Repo rates or Interest rates. An increase in these rates leads to an increase in the lending and borrowing rates, which may pose an obstacle to overseas funding. Apart from that, the interest rates in the banks for savings and deposits also increase. It is a belief that the higher the interest rates, the higher the cash inflow, which helps bolster the country's economic stability. When the world was at a standstill, India faced low-interest rates of 4% in the years 2020 and 2021. However, the rates have been rising since the beginning of 2022. The RBI is expected to increase the interest rates by 50 bases to 5.9% by the end of this year. It could reflect positively on the Indian rupee.

| RBI Bank Interest Rates | ||||

|---|---|---|---|---|

| Date | Rate (%) | |||

| Feb-19 | 6.25% | |||

| Apr-19 | 6.00% | |||

| Jun-19 | 5.75% | |||

| Aug-19 | 5.40% | |||

| Oct-19 | 5.15% | |||

| Mar-20 | 4.40% | |||

| May-20 | 4.00% | |||

| May-22 | 4.40% | |||

| Jun-22 | 4.90% | |||

Similarly, the US Federal Reserve, the central bank of the United States, has also taken necessary steps to curtail the inflation rates in the US. The fed has increased the interest rate by 75 basis points. Despite this increase, the inflation rates in the US hit an all-time high of 9.1%. The dollar's performance hasn't been impressive. However, the relative performance of the Indian rupee against the US dollar led to such a record-low value of the rupee.

| US Fed Interest Rates | ||||

|---|---|---|---|---|

| Date | Interest Rate | |||

| Jun-21 | 0.08 | |||

| Jul-21 | 0.10 | |||

| Aug-21 | 0.09 | |||

| Sep-21 | 0.08 | |||

| Oct-21 | 0.08 | |||

| Nov-21 | 0.08 | |||

| Dec-21 | 0.08 | |||

| Jan-22 | 0.08 | |||

| Feb-22 | 0.08 | |||

| Mar-22 | 0.20 | |||

| Apr-22 | 0.33 | |||

| May-22 | 0.77 | |||

| Jun-22 | 1.21 | |||

| Jul-22 | 1.58 | |||

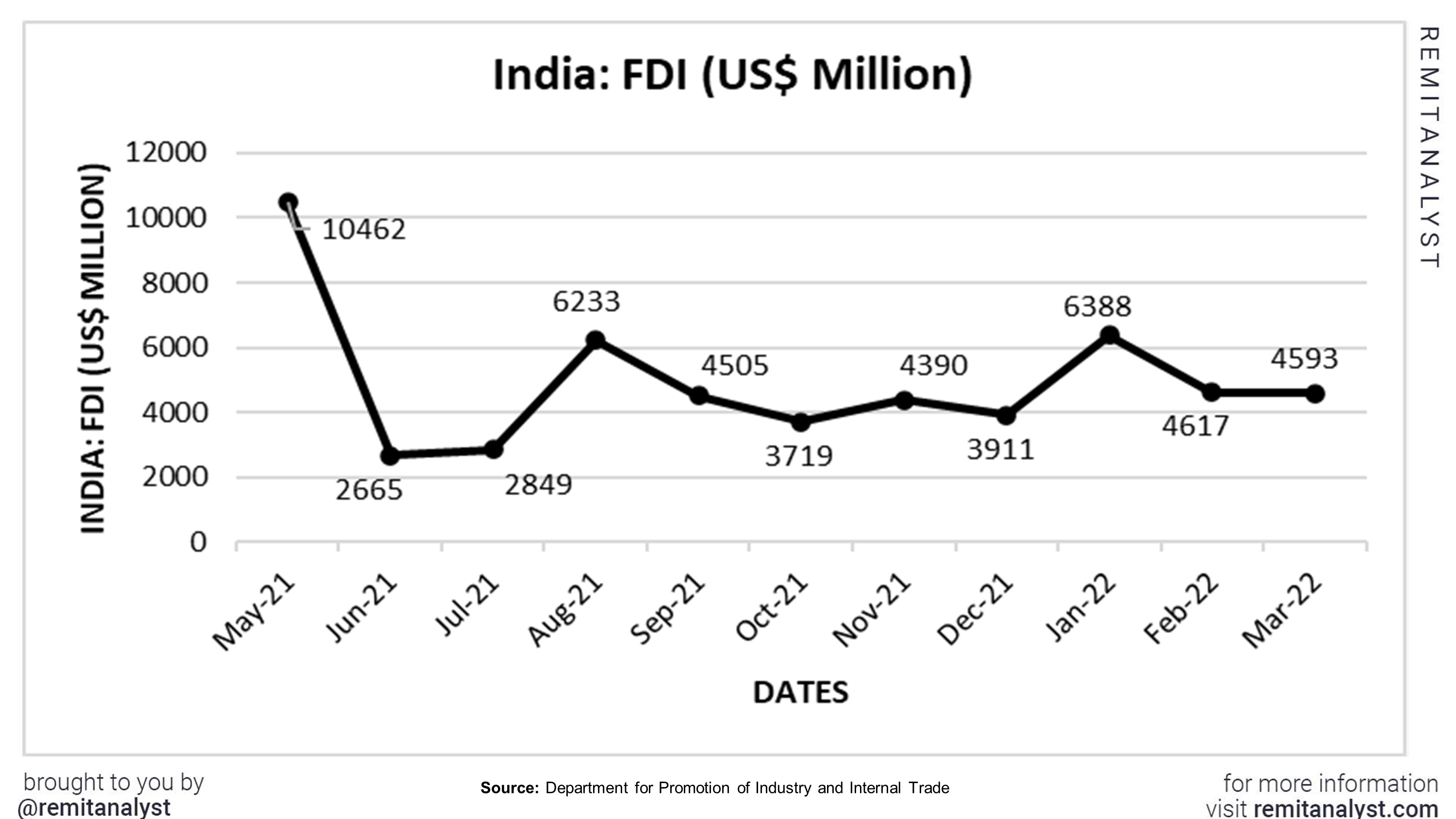

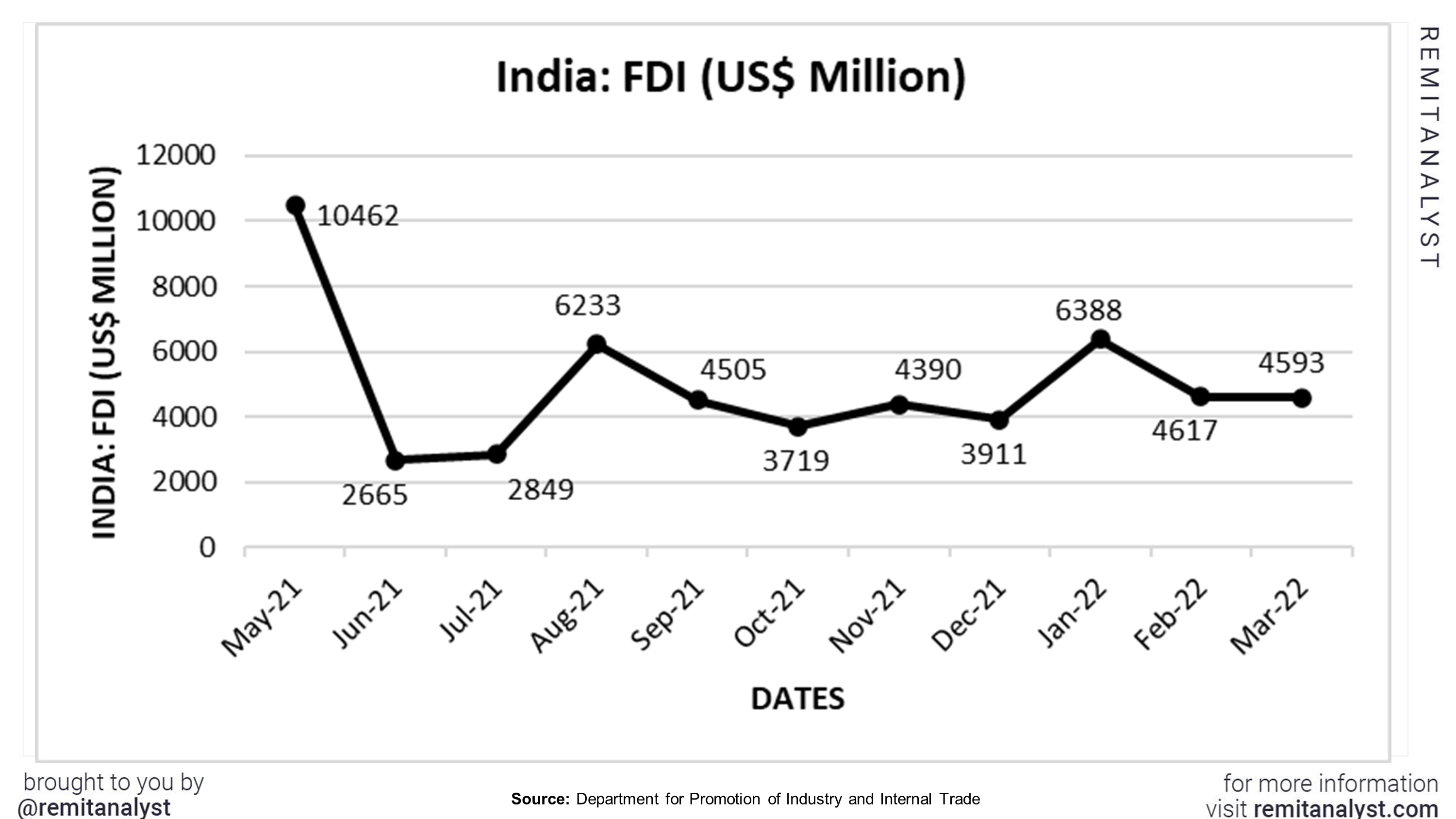

6. Foreign and Domestic Investment

Generally, foreign investments increase when there is an increase in the repo rates. It has both positive and negative consequences. High cash inflow poses to be a boon, whereas the bane is when the RBI buys more USD. That is, the value of the rupee decreases when the RBI buys more USD, and the value increases when the RBI sells more USD. In the financial year 2021-22, around $83B worth of foreign investments were made. The financial year 2022-23 is predicted to cross-assets worth more than $100B. It could only suggest that the value of the rupee is expected to fall further.

| India's FDI | ||||

|---|---|---|---|---|

| Date | FDI (US$ Million) | |||

| May-21 | 10462 | |||

| Jun-21 | 2665 | |||

| Jul-21 | 2849 | |||

| Aug-21 | 6233 | |||

| Sep-21 | 4505 | |||

| Oct-21 | 3719 | |||

| Nov-21 | 4390 | |||

| Dec-21 | 3911 | |||

| Jan-22 | 6388 | |||

| Feb-22 | 4617 | |||

| Mar-22 | 4593 | |||

On the contrary, a decline in domestic investments could reflect a rise in inflation, which causes the devaluation of the rupee. For instance, the rising inflation could lead to a decrease in consumer spending. The spending decreased from 23304. 25B INR in the fourth quarter of 2022 to 22624. 15B INR in the first quarter of 2022. The graph below suggests that the FDI equity inflow has been decreasing and is expected to decline unless the Indian economy regains stability.

The government, RBI, and other ancillary supporting agencies are working hard to restore the economy and the currency. With several factors, permutations, and conditions, it is hard to pinpoint an exact reason for such poor performance as every aspect is interrelated and interdependent. Several contingency plans, such as a hike in the gold tax and repo rates, are being imposed. The economy and currency are expected to gain stability and positive momentum by 2023.