Why is the USD to INR Exchange Rate up today on 18th July 2022 (1st half of July 2022)?

The Indian economy has been volatile. The rupee fell to an all-time low against the dollar, with $1 equalling 80 rupees. This may seem as a positive sign for foreign investors; however, the situation is worrying as the currency projects the government’s policies that affect the country’s economy, and political and economic stability. India’s central bank, the reserve bank of India is responsible for controlling the country’s currency. The RBI comes up with monetary policies that help bolster the rupee. It also protects macroeconomic stability.

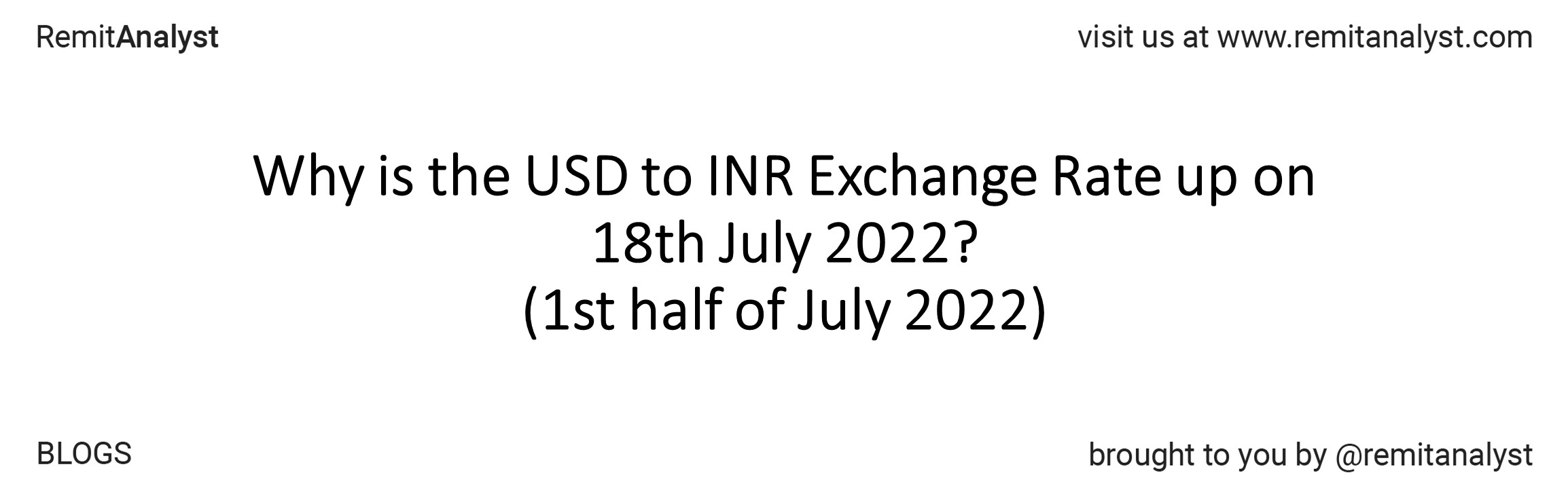

| USD to INR Exchange Rates (1 USD into INR) | ||||

|---|---|---|---|---|

| Date | Open | High | Low | Close |

| 04-Jul-22 | 78.95 | 79.05 | 78.85 | 78.95 |

| 05-Jul-22 | 78.94 | 79.42 | 78.91 | 78.94 |

| 06-Jul-22 | 79.37 | 79.55 | 78.93 | 79.37 |

| 07-Jul-22 | 79.04 | 79.25 | 78.88 | 79.04 |

| 08-Jul-22 | 79.22 | 79.42 | 79.11 | 79.22 |

| 11-Jul-22 | 79.33 | 79.58 | 79.14 | 79.33 |

| 12-Jul-22 | 79.48 | 79.86 | 79.39 | 79.48 |

| 13-Jul-22 | 79.48 | 80.06 | 79.43 | 79.48 |

| 14-Jul-22 | 79.81 | 80.22 | 79.60 | 79.81 |

| 15-Jul-22 | 79.88 | 80.09 | 79.71 | 79.88 |

| 18-Jul-22 | 79.72 | 80.26 | 79.71 | 79.72 |

Taking a deep dive into the USD to INR exchange rates, we can observe that the rupee has been falling between the 4th of July 2022 and the 18th of July 2022. The rupee hit an all-time low of 80.2 against the dollar on the 18th of July 2022 and a high of 78.8 on 4th of July 2022. The currency improved slightly on the 7th of July 2022, but that was temporary. The rupee’s value has declined ever since. $1 was equivalent to an average of 79.4 rupees, as opposed to 78.2 in June 2022. The currency’s value differed positively or negatively by an average of 0.19 rupee every day in the past two weeks (4th of July 2022 to 18th of July 2022). If the currency has to be strong, there are so many factors that have to perform relatively well. They are:

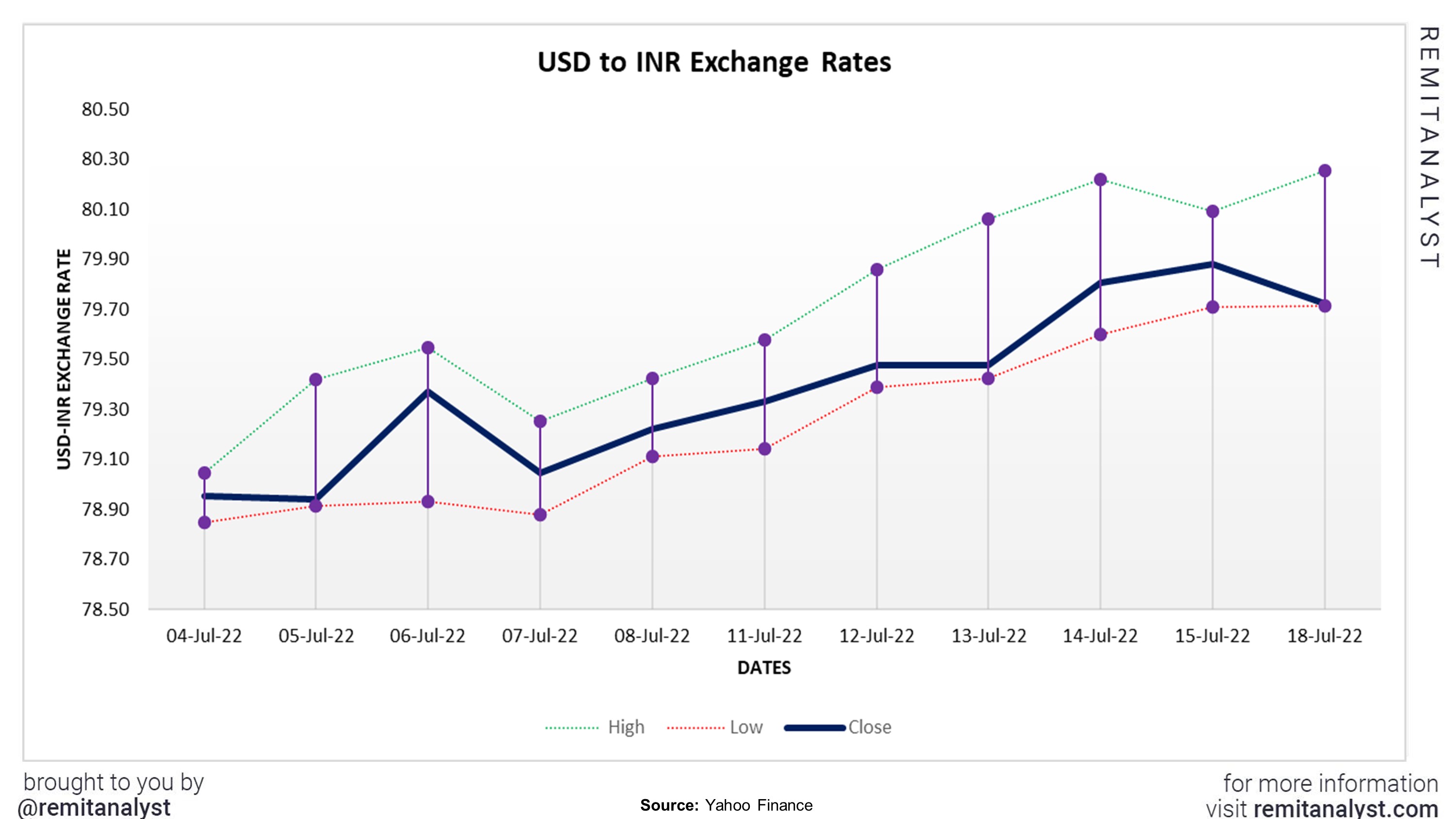

1. Crude Oil

Due to the on-set of the Ukraine- India conflict and the trade barriers, the prices of crude oil have been volatile. India imports over 85% of crude oil from other countries. In the first quarter of the financial year 2022- 23, India has imported 60.2 million tonnes of oil worth $47.5B USD. This cost was around 89% higher than the amount spent for crude oil in the first quarter of the financial year 2021-22. The domestic production of crude oil was had a very negligible increase of 0.62% from last year. The crude oil prices touched an all-time high of $120 per barrel in May 2022.

| Crude Oil (in USD) | ||||

|---|---|---|---|---|

| Date | Open | High | Low | Close |

| Jul-05-2022 | 108.80 | 111.45 | 97.43 | 99.50 |

| Jul-06-2022 | 100.36 | 102.14 | 95.10 | 98.53 |

| Jul-07-2022 | 98.22 | 104.48 | 96.57 | 102.73 |

| Jul-08-2022 | 102.22 | 105.24 | 101.51 | 104.79 |

| Jul-11-2022 | 104.79 | 105.05 | 100.89 | 104.09 |

| Jul-12-2022 | 103.46 | 103.49 | 95.35 | 95.84 |

| Jul-13-2022 | 95.89 | 97.96 | 93.67 | 96.30 |

| Jul-14-2022 | 96.57 | 97.00 | 90.56 | 95.78 |

| Jul-15-2022 | 96.39 | 99.03 | 94.57 | 97.59 |

| Jul-18-2022 | 97.27 | 102.80 | 95.85 | 102.60 |

The trend analysis suggests the prices have been volatile. Crude oil prices hit a nadir point of $90.56 per barrel on 14th of July 2022 and a zenith of $111.45 per barrel on 5th of July 2022. While the prices decreased from 8th of July 2022 to 12th of July 2022, it has been gradually increasing ever since. This could be a worrying sign for the Indian and global economy. A change in the price of crude oil can significantly affect the cost of production, transportation and manufacturing. An increase in the price of crude oil can also increase the price of goods as it increases the cost of production, which in turn could raise the inflation level. Thereby, decreasing the value of the Indian currency.

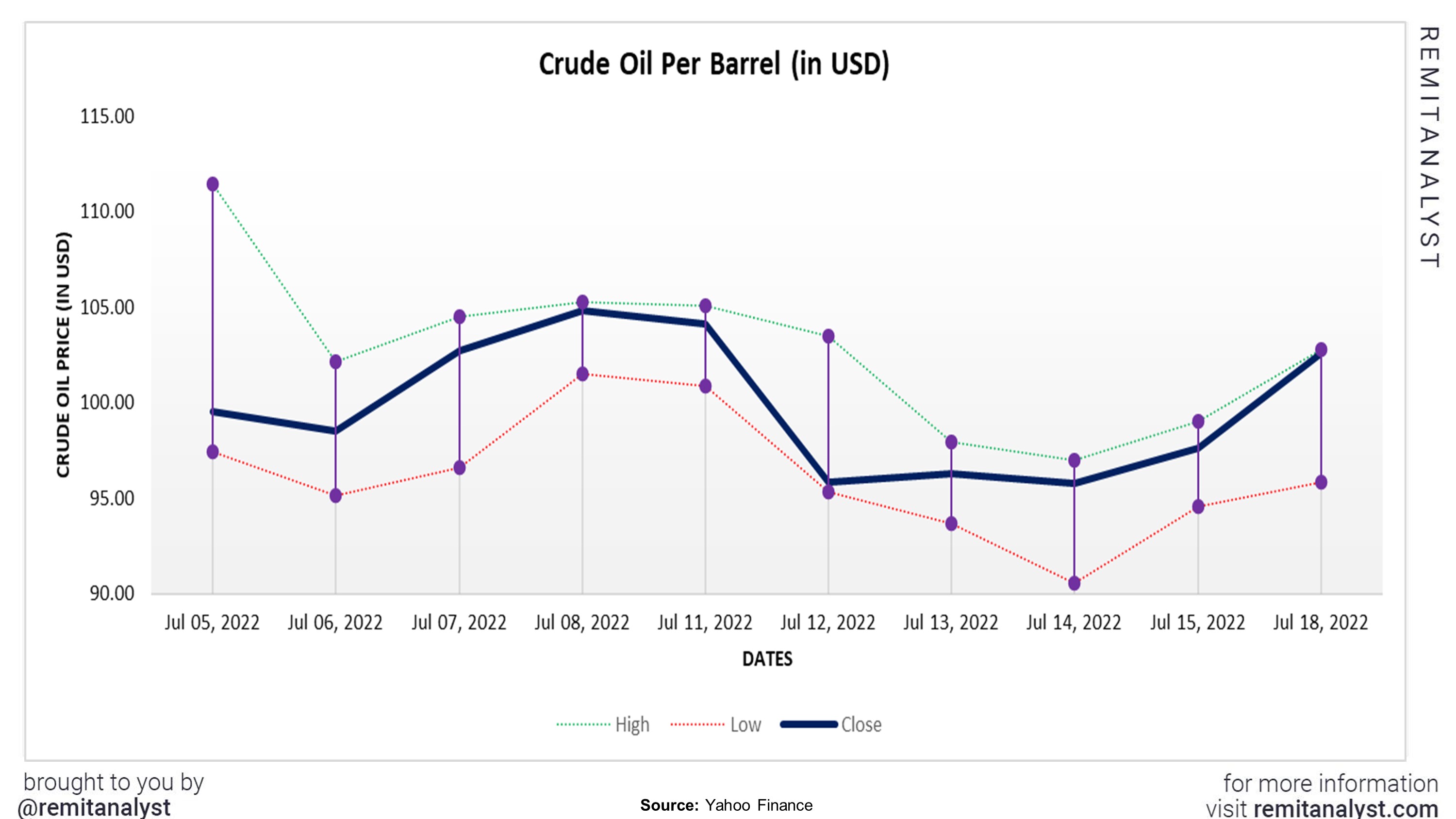

2 Gold imports

As of 30th of June 2022, India imported about 306.2 tonnes of gold. This had serious repercussion in terms of inflation as it rose significantly over 7% in June 2022. The government along with the RBI imposed a hike in gold import tax to try and curb the gold imports. The tax rate increased from 10.75 % to 15%. While the government is doing everything in its power to reduce the gold imports, the demand for the yellow metal has widened. India's demand for gold jumped 43% from a year ago to 170.7 tonnes in the quarter through June. On 5th of July 2022, gold price reached a high of $1805.4 per ounce, and a low of $1701.1 on the 15th of July, 2022. The price has been decreasing gradually which has also added fuel to the people’s desire to buy gold. On average, gold costed around $ 1732.5 per ounce.

| Gold Rate (in USD) | ||||

|---|---|---|---|---|

| Date | Open | High | Low | Close |

| Jul-05-2022 | 1,805.40 | 1,805.40 | 1,761.80 | 1,761.80 |

| Jul-06-2022 | 1,762.50 | 1,768.00 | 1,734.00 | 1,734.90 |

| Jul-07-2022 | 1,745.20 | 1,745.20 | 1,737.00 | 1,737.90 |

| Jul-08-2022 | 1,738.10 | 1,749.30 | 1,732.10 | 1,740.60 |

| Jul-11-2022 | 1,732.50 | 1,736.70 | 1,730.00 | 1,730.00 |

| Jul-12-2022 | 1,734.20 | 1,735.50 | 1,723.30 | 1,723.30 |

| Jul-13-2022 | 1,710.00 | 1,734.20 | 1,710.00 | 1,734.20 |

| Jul-14-2022 | 1,710.30 | 1,710.50 | 1,704.50 | 1,704.50 |

| Jul-15-2022 | 1,705.40 | 1,709.70 | 1,701.10 | 1,702.40 |

| Jul-18-2022 | 1,712.20 | 1,712.40 | 1,709.20 | 1,709.20 |

An increase in the purchase of gold can lead to the decline of the currency’s value as it increases the inflation rates. While the government is trying to curb the import rates, the Indian citizens must also try and cooperate. This poses as a worrying sign for the country and its economy.

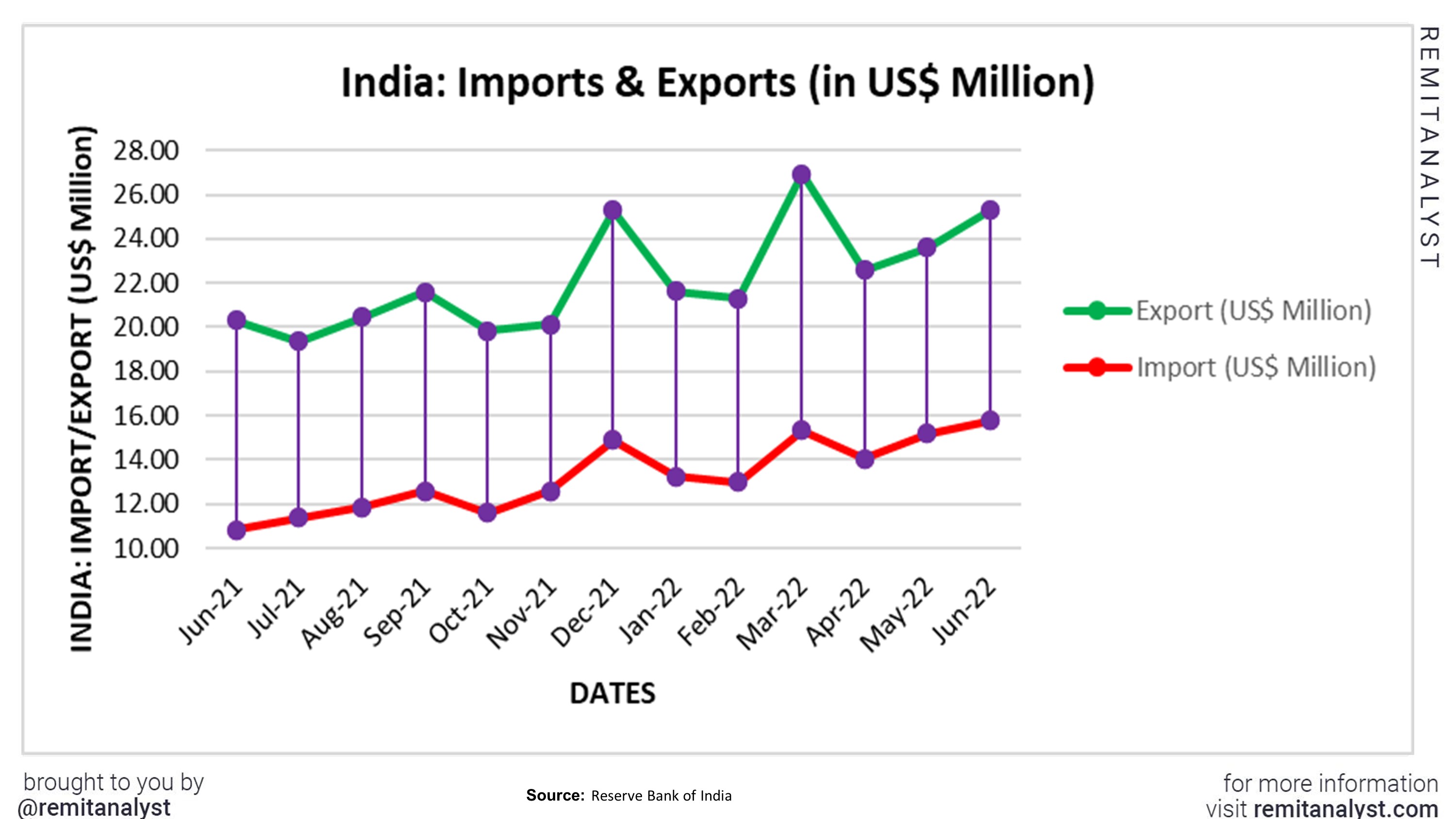

3. GDP & Import/Export

Imports/ Exports, trade deficit and the Gross domestic product or GDP are all interrelated. GDP rises when the exports exceed the imports, that is GDP increases with an increase in trade deficit. Which in turn increases the value of the country’s currency. GDP is also dependent on consumption and production rates.

| India: Imports & Exports (in US$ Million) | ||||

|---|---|---|---|---|

| Date | Export (US$ Million) | Import (US$ Million) | ||

| Jun-21 | 20.30 | 10.84 | ||

| Jul-21 | 19.36 | 11.39 | ||

| Aug-21 | 20.46 | 11.87 | ||

| Sep-21 | 21.61 | 12.58 | ||

| Oct-21 | 19.85 | 11.61 | ||

| Nov-21 | 20.14 | 12.59 | ||

| Dec-21 | 25.31 | 14.89 | ||

| Jan-22 | 21.63 | 13.24 | ||

| Feb-22 | 21.30 | 12.97 | ||

| Mar-22 | 26.95 | 15.35 | ||

| Apr-22 | 22.59 | 14.05 | ||

| May-22 | 23.61 | 15.20 | ||

| Jun-22 | 25.29 | 15.77 | ||

The graph below shows that the trade deficit gap has been widening unpredictably. From April 2022 to June 2022, both the imports and exports have had a linear growth making almost negligible difference in the trade deficit. India had a deficit of $8.411M USD in May 2022. This has increased to $ 9.525M USD in June 2022. This increase is worrying.

| India: GDP Rate | ||||

|---|---|---|---|---|

| Date | Rate (%) | |||

| Jul-19 | 6.25% | |||

| Aug-19 | 6.00% | |||

| Jun-19 | 5.75% | |||

| Aug-19 | 5.40% | |||

| Oct-19 | 5.15% | |||

| Mar-20 | 4.40% | |||

| May-20 | 4.00% | |||

| May-22 | 4.40% | |||

| Jun-22 | 4.90% | |||

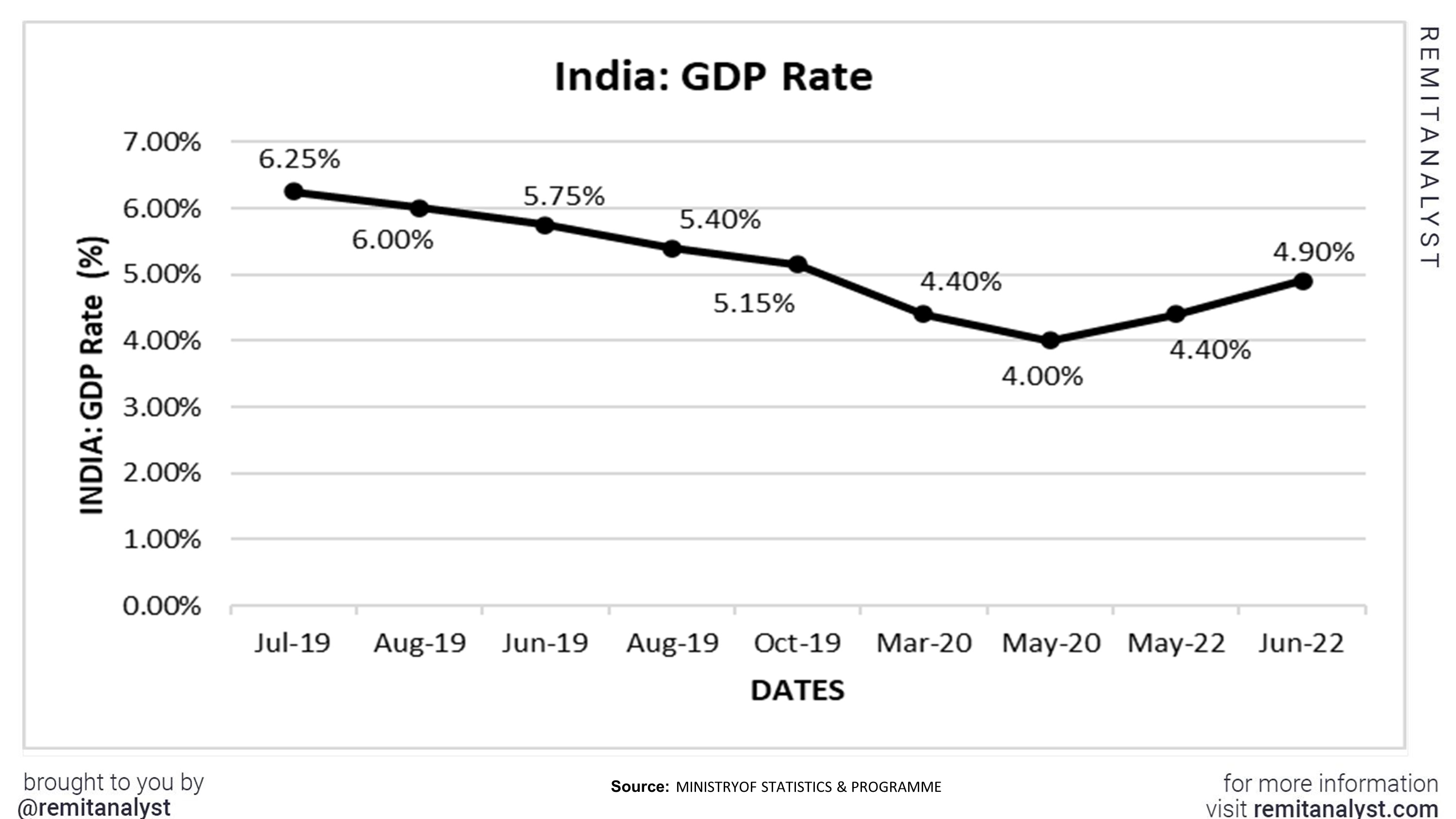

Though the trade deficit has increased, the GDP has grown instead of declining. The GDP has increased from 4.4% in May 2022 to 4.9% in June, 2022. However, this growth is slow. The Indian government and the RBI aims at recovering and restoring the GDP rates by 2023. This seems like a positive sign for the country’s economy and currency.

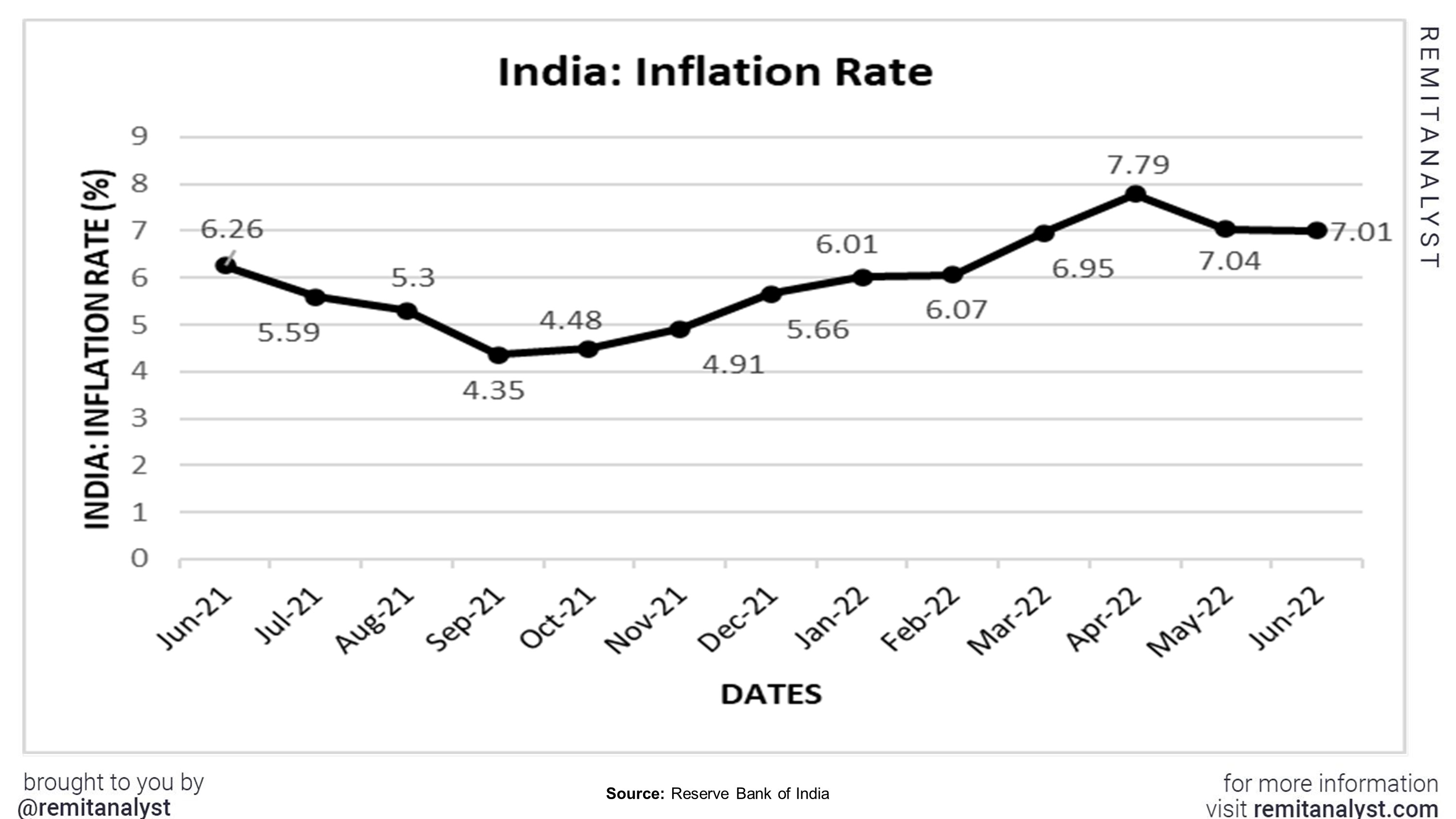

4. Inflation rates

A rise in inflation rates is considered dangerous as it can devalue a currency by decreasing its buying power. India’s inflation rates have been increasing since September 2021. The growth appeared to stabilize in the months of January and February of 2022.

| India: Inflation Rate | ||||

|---|---|---|---|---|

| Date | Rate (%) | |||

| Jun-21 | 6.26 | |||

| Jul-21 | 5.59 | |||

| Aug-21 | 5.3 | |||

| Sep-21 | 4.35 | |||

| Oct-21 | 4.48 | |||

| Nov-21 | 4.91 | |||

| Dec-21 | 5.66 | |||

| Jan-22 | 6.01 | |||

| Feb-22 | 6.07 | |||

| Mar-22 | 6.95 | |||

| Apr-22 | 7.79 | |||

| May-22 | 7.04 | |||

| Jun-22 | 7.01 | |||

However, it rose significantly in March and April of 2022. From 7.79% in April 2022, the inflation rates have fallen to 7.01% in June 2022. This is a positive sign for the Indian economy and rupee. Combined efforts of the RBI, and other supporting government bodies have led to this dip. However, the currency’s performance against the dollar does not reflect that.

| US: Inflation Rate | ||||

|---|---|---|---|---|

| Date | Rate (%) | |||

| Jun-21 | 5.4 | |||

| Jul-21 | 5.4 | |||

| Aug-21 | 5.3 | |||

| Sep-21 | 5.4 | |||

| Oct-21 | 6.2 | |||

| Nov-21 | 6.8 | |||

| Dec-21 | 7 | |||

| Jan-22 | 7.5 | |||

| Feb-22 | 7.9 | |||

| Mar-22 | 8.5 | |||

| Apr-22 | 8.3 | |||

| May-22 | 8.6 | |||

| Jun-22 | 9.1 | |||

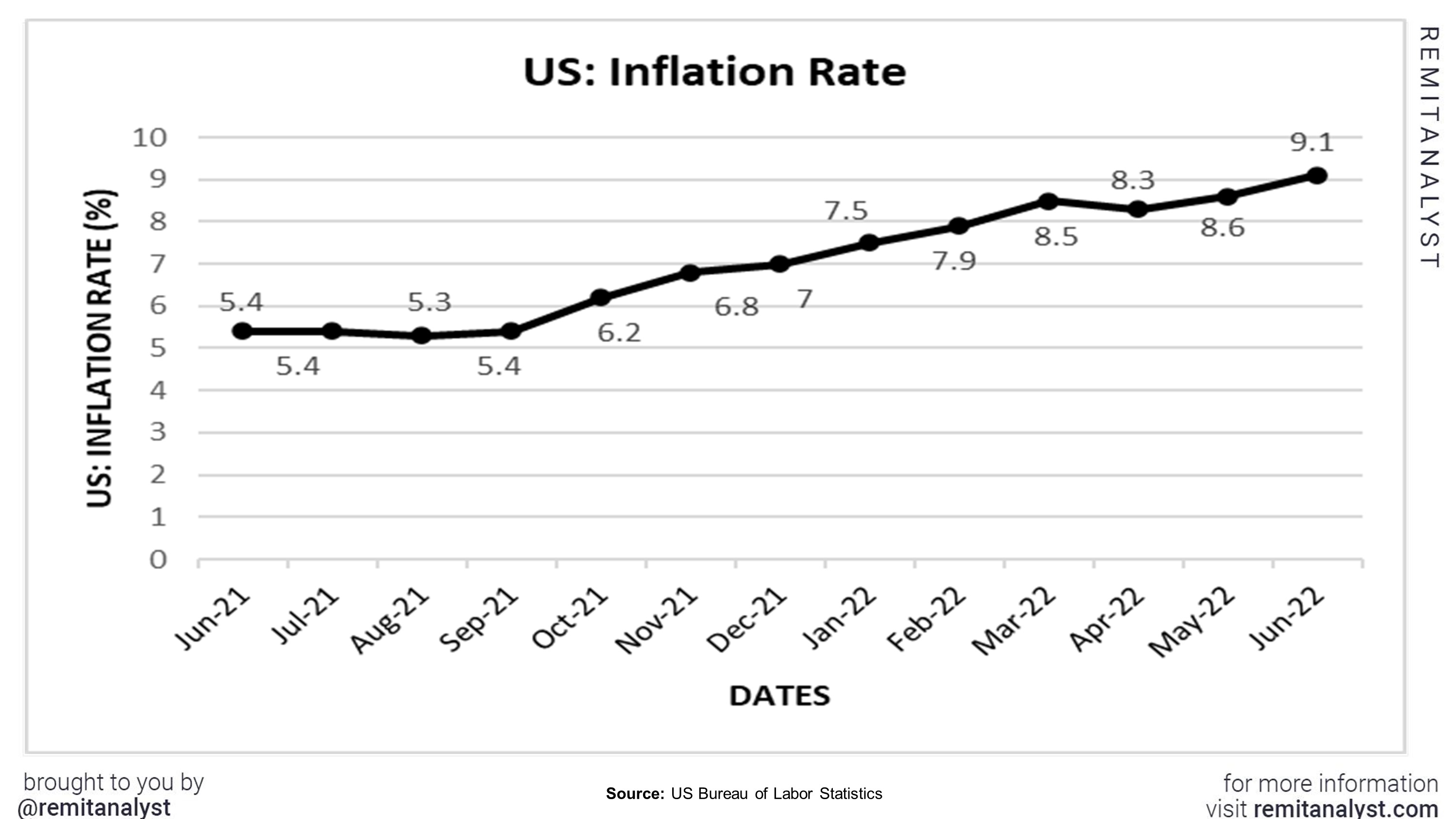

On the other hand, from the above graph and table one can see that even in the United States, inflation rates have been rising. Inflation rate decreased from 8.5% in March 2022 to 8.6% in May 2022. However, it has increased to 9.1% in June 2022. While, the US Federal reserve has been taking precautionary steps to curb the inflation, the inflation rates are expected to increase until it stabilizes in late 2023 and early 2024. This significantly affects the performance of the US dollar.

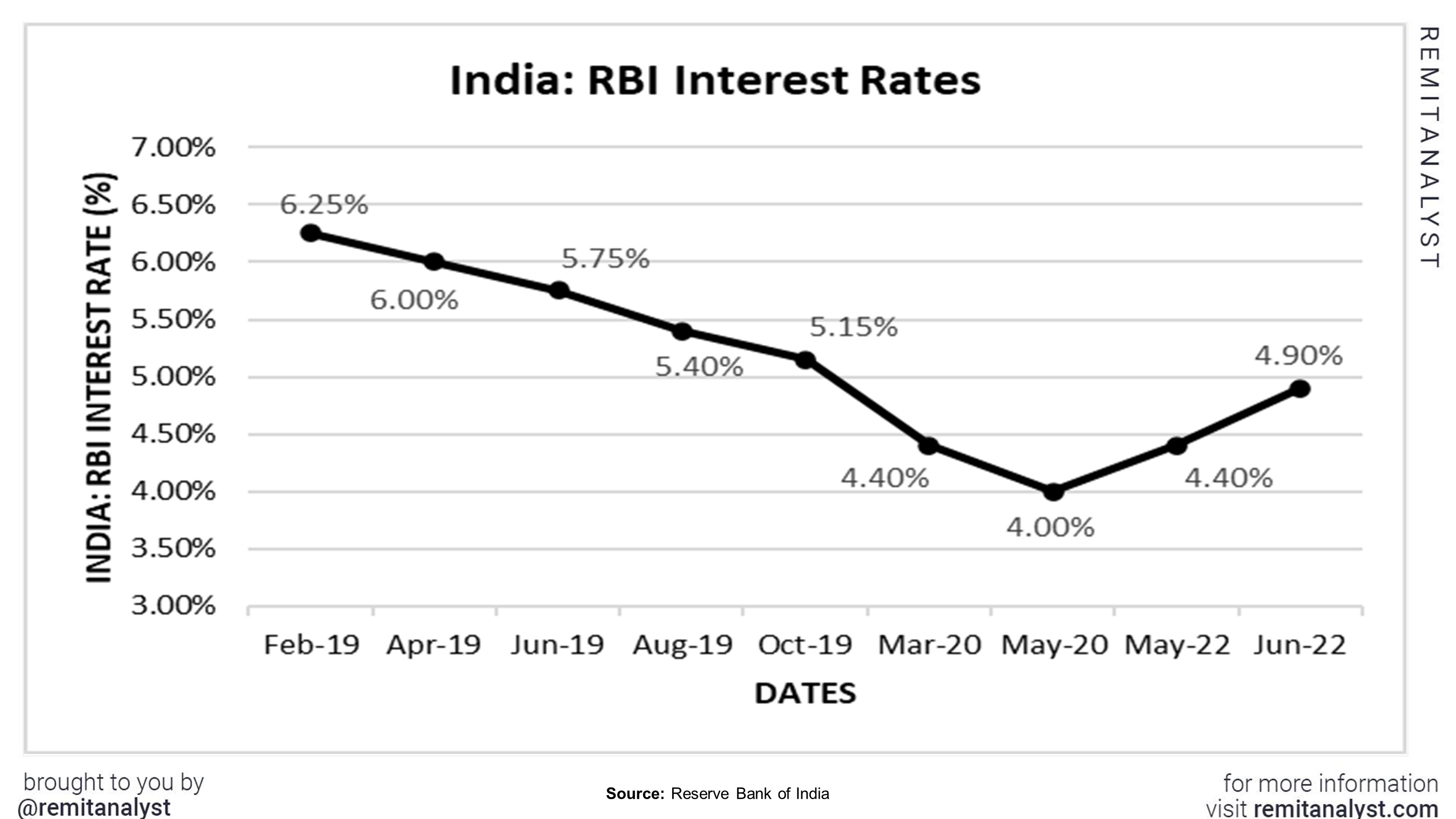

5. Interest rates

Playing with the interest rates is one of the many textbook methods that a country’s central bank uses to control the inflation rates. Higher interest rates attract more foreign investments that helps boost the country’s economy, which then buttresses the country’s currency

| India: RBI Interest Rates | ||||

|---|---|---|---|---|

| Date | Rate (%) | |||

| Feb-19 | 6.25% | |||

| Apr-19 | 6.00% | |||

| Jun-19 | 5.75% | |||

| Aug-19 | 5.40% | |||

| Oct-19 | 5.15% | |||

| Mar-20 | 4.40% | |||

| May-20 | 4.00% | |||

| May-22 | 4.40% | |||

| Jun-22 | 4.90% | |||

India faced a low interest rate of 4% in the years 2020, and 2021. However, the rates have been rising since the beginning of 2022. The RBI is expected to increase the interest rates to 5.9% by the end of this year. This could reflect positively on the Indian rupee.

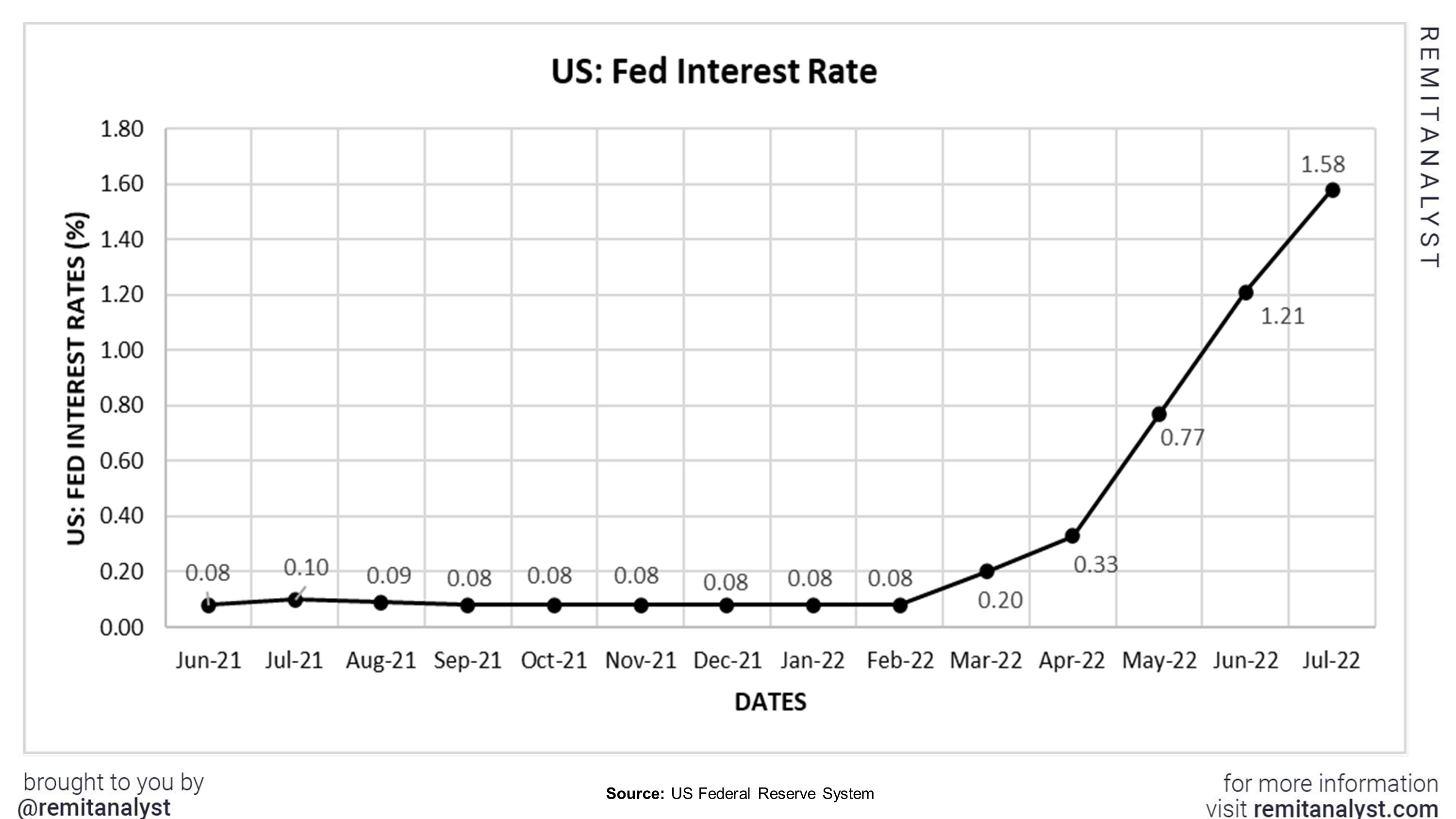

Similarly, the US Federal Reserve has also taken necessary steps to curb the inflation rates in the US. The fed has increased the interest rate by 75 basis points. Despite this increase, the inflation rates in the US hit an all time high of 9.1%. This coupled with the crude oil prices led to the poor performance of the dollar. Nevertheless, the Indian rupee’s relative performance against the dollar led to such a record-low value.

| US: Fed Interest Rate | ||||

|---|---|---|---|---|

| Date | Rate (%) | |||

| Jun-21 | 0.08 | |||

| Jul-21 | 0.10 | |||

| Aug-21 | 0.09 | |||

| Sep-21 | 0.08 | |||

| Oct-21 | 0.08 | |||

| Nov-21 | 0.08 | |||

| Dec-21 | 0.08 | |||

| Jan-22 | 0.08 | |||

| Feb-22 | 0.08 | |||

| Mar-22 | 0.20 | |||

| Apr-22 | 0.33 | |||

| May-22 | 0.77 | |||

| Jun-22 | 1.21 | |||

| Jul-22 | 1.58 | |||

While rising interest rates is seen as a boon, it can also act as a bane. An increase in interest rates can lead to an increase in borrowing rate which may pose as a hindrance to overseas funding.

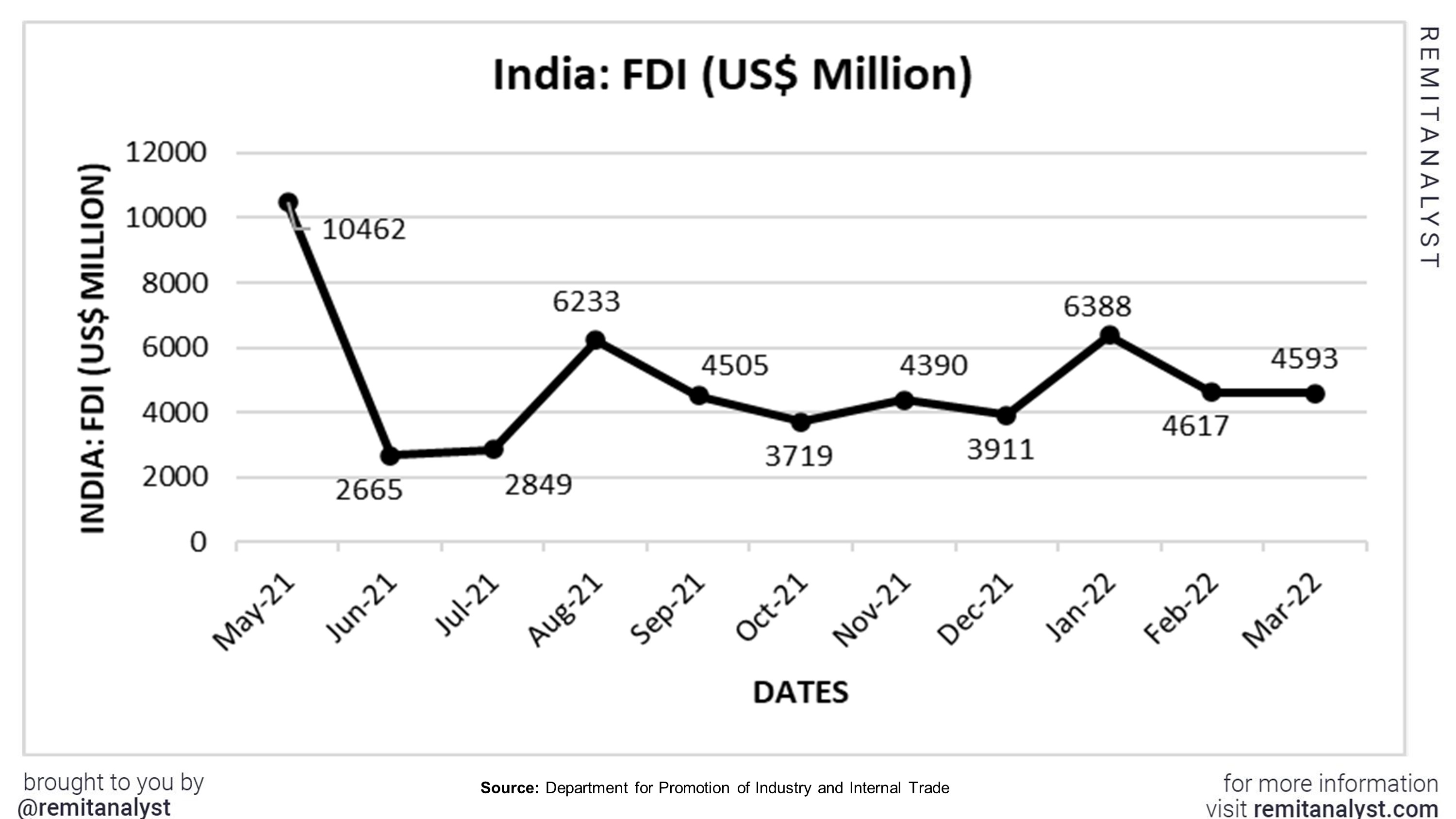

6. Foreign and Domestic Investment

Foreign investments increase when there is an increase in the interest rates. While it may have some positive effects in terms of cash inflow into the country, it also has negative effects. When the RBI buys more USD, the value of the rupee decreases, whereas, when the RBI sells in USD, the value of the currency increases. In the financial year 2021-22, around $83B worth of foreign investments were made. The financial year 2022-23 is predicted to cross investments worth more than $100B. This could only suggest that the value of the rupee is expected to fall further.

| India: FDI (US$ Million) | ||||

|---|---|---|---|---|

| Date | FDI (US$ Million) | |||

| May-21 | 10462 | |||

| Jun-21 | 2665 | |||

| Jul-21 | 2849 | |||

| Aug-21 | 6233 | |||

| Sep-21 | 4505 | |||

| Oct-21 | 3719 | |||

| Nov-21 | 4390 | |||

| Dec-21 | 3911 | |||

| Jan-22 | 6388 | |||

| Feb-22 | 4617 | |||

| Mar-22 | 4593 | |||

On the other hand, a decline in the domestic investments could reflect a rise in inflation, which causes the devaluation of the rupee. For instance, the rising inflation led to the decrease in consumer spending from 23304. 25B INR in the fourth quarter of 2022 to 22624. 15B INR in the first quarter of 2022. The graph below suggests the FDI equity inflow has been decreasing and is expected to decrease unless the Indian economy regains some stability.

Since there are several factors that have a direct and indirect effect on the rupee, it is difficult to pinpoint the exact reason for the rupee’s poor performance against the dollar. The government, RBI and other support bodies are trying to come up precautionary measures to boost the value of the currency. Hike in gold import tax, GST, interest rates are some of the measures taken by the government to try and curb the inflation rates, and the trade deficit. The government hopes that the rupee will recover by 2023.