Resident alien vs Non-resident alien

I am sure many of you are confused about whether you are a resident alien or a non-resident alien for tax purposes. This blog answers all your questions regarding your residency status in United States of America and at the end of this blog, you are certain to gain clarity.

First, there are some definitions which needed to be

mentioned.

Alien:

An individual, who is not a United States citizen is

considered as an “alien”. The Internal Revenue Services (IRS) classifies aliens

as either “Resident Aliens” or “Non-Resident Aliens”.

·

Resident

alien: A resident alien is a foreign-born United States resident, who is

not a U.S. citizen. A resident alien is also known as a permanent resident or a

lawful permanent resident, which means they are considered “an immigrant” who

has been legally and lawfully recorded as a resident of the country.

According to the United States Citizenship and Immigration Services (USCIS), there are three types of resident alien:

1. Permanent Resident: An individual, who is given lawful and legal right by the government to live in the United States is considered as a “Permanent Resident”.

2. Conditional Resident: An individual, who is given a two-year green card after applying for a residency based on marriage or because he/she is an entrepreneur, is considered as a “Conditional Resident”.

3. Returning Resident: An individual, who has been outside the U.S. and is returning to the country is considered as a “Returning Resident”. Such individual is also known as a "special immigrant" and must apply for readmission if outside the U.S. for more than 180 days.

A resident alien must have a green card or pass a substantial presence test. In general, a resident alien is subject to the same taxes as a U.S. citizen.

Forms to be filed by a Resident Alien: Form 1040 for U.S. Individual

Income Tax Return (PDF) or Form 1040-SR for U.S. Tax

Return for Seniors (PDF)

·

Non-Resident

Alien: An individual, who is neither a U.S. citizen nor a resident alien,

is considered as a non-resident alien for tax purposes. If a person does not

meet the criteria of either the Green Card Test or Substantial Presence Test

then, that individual is classified as a non-resident alien.

Presence Test and Green Card Test:

1. Green Card Test: This applies to an individual, who has U.S. permanent or conditional residence, or a green card. This individual is a citizen of another country, who is authorized to live and work in the U.S. on a permanent basis (or in the case of a conditional resident, for two years that may then be continued into a permanent stay). By the very nature of the requirements placed upon permanent residents, they spend most of their time living in the United States. To keep a green card, an individual must not make primary home in another country, nor remain outside the US for more than one year. (Individuals, who plan to remain outside the United States for more than one year can however, apply for a re-entry permit before leaving, in order to preserve the green card.)

2. The Substantial Presence Test: An individual, who satisfies the substantial presence test, and are therefore treated as a resident alien for that entire calendar year, if an individual has been physically present in the United States for at least:

a) 31 days during the current year (Count days even if you’re an exempt individual), and

b) 183 days during the 3-year period that includes the current year and the 2 years immediately preceding the current year

If one satisfies both I and II conditions, then he/she will

be eligible to be considered as a “Resident Alien”.

To satisfy condition II above, an individual should be

present for more than 183 days calculated in three-year time period as shown

below:

·

All of

the days you were present in the current year (Don’t count days when you’re

an exempt individual)

·

One-third

of the days you were present in the first year before the current year (Don’t

count days when you’re an exempt individual), and

·

One-sixth

of the days you were present in the second year before the current year (Don’t

count days when you’re an exempt individual)

Note: For the

presence test, do not count the days when you were an exempt-individual.

Forms to file for Non-Resident Alien: Form 1040-NR (PDF) or Form 1040-NR-EZ (PDF)

Exempt-Individual Definition:

Exempt individuals are teachers and students (on an F, J, M,

or Q visa) who haven't stayed in the U.S. beyond a certain period of time,

people who couldn't leave because of required medical treatment and people who

spent time in transiting via United States (for less than 24 hours).

Here are some examples to help you

determine if you are considered as a resident alien or a non-resident alien for

tax purposes:

Example 1

Date of entry in United States: 5th of January, 2017

Visa: F1 student visa

Purpose of staying in US: MS program

Question: Does

this individual need to file their 2019 tax return as a resident alien or as a

non-resident alien?

Answer: As a

non-resident alien.

Note: F1 student

visa makes you an exempt individual for 5 calendar years (according to this

example it is from 2017 through 2021)

Count days as follows:

1. Days of current calendar year (2019) in US = (365) * 1 = 0 Days (Don’t count days when you’re an exempt individual)

2. Days of prior calendar year (2018) in US = (0) * 1/3 = 0 Days (Don’t count days when you’re an exempt individual)

3. Days of calendar year before (2017) in US = (0) * 1/6 = 0 Days (Don’t count days when you’re an exempt individual)

Therefore, none of the conditions (condition I and condition II) of the presence test are met. Hence the individual has to fill 2019 Taxes as Non-Resident Alien. The individual will become a resident alien on 183rd day of the calendar year 2022 (When an individual will meet both conditions I and II) & for the entire year of 2022, individual will be considered as a Resident Alien.

Example 2

Date of entry in United States: 10th of August, 2014

Visa: F1 student visa

Purpose of staying in US: MS + PhD program

Question: Does

this individual need to file their 2019 tax return as a resident alien or as a

non-resident alien?

Answer: As a

resident alien.

Note: F1 student

visa makes you an exempt individual for 5 calendar years (2014 through 2018)

Count days as follows:

1. Days of current calendar year (2019) in US = (365) * 1 = 365 Days (Not an exempt individual anymore as 5 years have been passed)

2. Days of prior calendar year (2018) in US = (0) * 1/3 = 0 Days (Don’t count days when you’re an exempt individual)

3. Days of calendar year before (2017) in US = (0) * 1/6 = 0 Days (Don’t count days when you’re an exempt individual)

Therefore, both of the conditions (condition I and condition II) of the subsequent presence test are met. Hence the individual has to fill 2019 Taxes as resident alien. This individual became a resident alien on 183rd day of the calendar year 2019 (when this individual met both conditions I and II) and for the entire year of 2019, he/she is considered as a resident alien.

Example 3

Date of entry in United States: 19th of December, 2017

Visa: F1 student visa + H1B work visa (From 1st of October 2019)

Purpose of staying in US: MS + OPT

Question: Does

this individual need to file their 2019 tax return as a resident alien or as a

non-resident alien?

Answer: As a

non-resident alien.

Note: H1B visa

makes you a non-exempt individual from 1st of October of the same year in which

H1B gets approved.

For further clarity on this, count the number of days as follows:

1. Days of current calendar year of 2019 in US = (91) * 1 = 91 Days (Exempt individual until 30th of September and non-exempt individual from 1st of October)

2. Days of prior calendar year of 2018 in US = (0) * 1/3 = 0 Days (Don’t count days when you’re an exempt individual)

3. Days of calendar year of 2017 in US = (0) * 1/6 = 0 Days (Don’t count days when you’re an exempt individual)

Therefore, condition I of the substantial presence test is met but condition II is not met. Hence the individual has to file 2019 Taxes as non-resident alien. This individual will become a resident alien on 92nd day (91 Days in 2019 + 92 Days in 2020 = 183 Days during the 3-year period that includes the current year and the 2 years immediately preceding the current year of the calendar year 2020 (when he/she met both conditions I and II) and for the entire year of 2020, this individual will be considered as a resident alien. You can find more examples by visiting the link in [2].

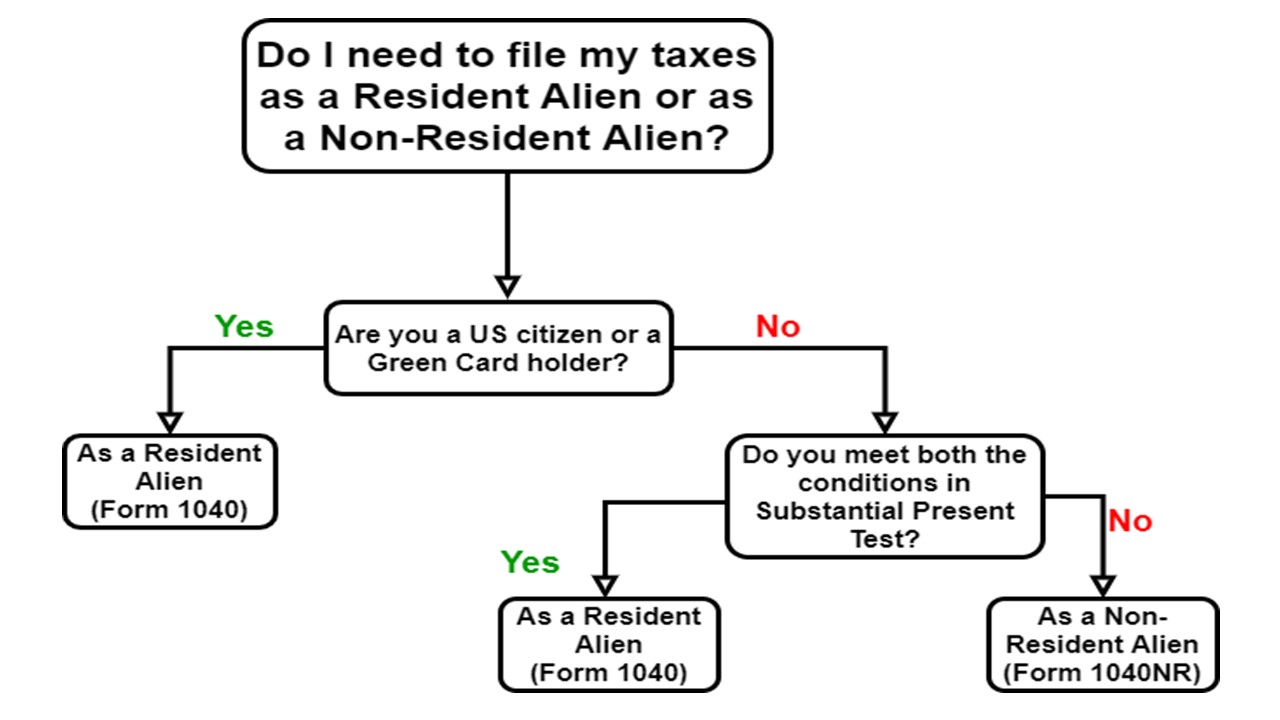

Here is a flowchart

to simplify the process of determining resident alien vs non-resident alien for

tax purposes:

References:

https://www.irs.gov/individuals/international-taxpayers/substantial-presence-test

https://www.irs.gov/individuals/international-taxpayers/alien-residency-examples